People with personal savings are interested in the question of profitable investment. One of the attractive investment assets is gold from a pawnshop.

During periods of lack of economic stability, foreign currency deposits are characterized by increased risk due to unpredictable fluctuations in exchange rates. Prices for precious metals are relatively stable. Short-term price fluctuations are inevitable, but in the long term, investing in gold will yield impressive profits.

Selling gold to a pawnshop: pros and cons

Despite the prejudices of many people regarding pawning gold jewelry, going to a pawnshop has significant advantages, including:

- The ability to receive money in just 15-30 minutes if you have, in fact, jewelry, as well as a passport or driver’s license;

- There is no application to fill out;

- The agreement with the pawnshop can be terminated early, without paying additional interest;

Gold ring with cubic zirconia (go to the SUNLIGHT catalog)

But pawnshops also have their disadvantages:

- If the jewelry is in poor condition or broken, it will be accepted very cheaply (at the price of scrap);

- The conditions for the delivery of gold are such that when pledged, the interest will be significantly higher than on a bank loan;

- The amount received from the pledge will be at your disposal for a short period of time - usually no more than a month.

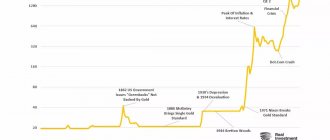

Basel III: the global financial revolution

On March 29 of this year, Basel III, developed by the Basel Committee on Banking Supervision, came into force, returning gold to its historical significance. In short, about 40 years ago, the same committee abolished the gold backing of the dollar, making US currency and Treasury obligations virtually the only valuable instrument in the world. How and why this happened is a long and dark story. Gold was simply turned from a universal equivalent into a market commodity, like oil or cotton. In bank reserves, gold can now be accounted for only at half its value, which means that it is unprofitable to purchase and store it, since it is possible to issue loans and money into circulation only at half its market value.

Despite this, today it is the US Central Bank that has the largest official gold reserves in the world - 8,133 tons. For example, Germany, second on the list, has more than two times less gold - 3,369 tons. Russia, with all of last year’s increase, ultimately has 2,119 tons of gold in its reserves. So, Basel III says that from now on gold is a full participant in group 1 of assets, equal to the dollar.

This means that the interest of states, banks and private investors in it should also increase. For example, instead of dubious dollars and treasury bonds of other countries, countries can store their entire funds in real, shiny, highly liquid bullion. In our own vaults, under full control, and not increasing the influence of other countries through demand for their currency and securities.

Experts explain the long-term decline in the value of the metal (from approximately 2012 to 2021) precisely by the global game in the market, through which prices were artificially lowered in order to buy large volumes at a low price - after all, the entry into force of Basel III was known already in 2011.

Rules for handing over gold to a pawnshop without redemption

It's no secret that pawnshops accept gold at a price lower than in jewelry stores. There is no deception here - stores and workshops include in the cost of jewelry not only materials, but also the work of the jeweler who created the product specifically for the store. It makes no sense for the pawnshop to overpay for the efforts of the master.

The pawnshop also accepts gold with stones. The weight of the gemstones and the overall condition of the jewelry are not taken into account when assessing. The presence of a sample is also not important - if necessary, a pawnshop employee will check the sample in front of you. However, keep in mind: if your item is broken or in completely unusable condition, it will only be valued as scrap.

Gold necklace with cubic zirconia (go to the SUNLIGHT catalogue)

After purchasing a piece of jewelry, the pawnshop has the right to put it up for sale at a higher price. Don't be surprised if you suddenly see your ring with a big price tag on display.

Is it profitable to invest money in gold?

But these are all big games, but what should an ordinary person do and why does he need gold? About the same thing that countries need: to preserve what they have acquired, to save money from inflation and devaluation. And precious metals are starting and winning here.

The table below shows the approximate value of gold and the dollar over a period of 21 years at various intervals. It can be seen that the 1998 crisis increased the price of the dollar by 4.5 times, and the increase in the price of gold due to two factors - the real exchange rate on the international market, and the increase in the price of the currency gave an increase of almost 10 times. In other words, if you invested equal amounts of rubles in the dollar and in gold, then after selling them after the crisis on gold you would have earned 2 times more.

During the 2014 crisis, the situation was a little worse: with a similar strategy, investing in the dollar would have been 20% more profitable than in gold, but during this period, as noted above, there was already a forced reduction in gold prices on the global market. In any case, the gain from investing is 1.8 times compared to the ruble. Let's calculate, on a very average basis, today's gold and dollar prices to the rates of the crisis years. And we clearly see that the ruble price of gold is growing stronger than the dollar!

| Assets | July 1998 | July 2006 | July 2008 | July 2009 | July 2011 | July 2012 | July 2013 | July 2014 | July 2015 | July 2019 | June 2021 to July 1998 | June 2021 to July 2008 | June 2021 to July 2015 |

| Dollar, rub. | 6 | 27 | 23 | 33 | 28 | 32 | 32 | 35 | 57 | 63 | 10,5 | 2,7 | 1,1 |

| Gold 999, rubles/gram | 60 | 560 | 710 | 940 | 1440 | 1650 | 1340 | 1450 | 2030 | 2840 | 47,3 | 4,0 | 1,4 |

| 999 gold, dollar/ounce | 260 | 654 | 950 | 937 | 1600 | 1571 | 1240 | 1300 | 1154 | 1413 | 5,4 | 1,5 | 1,2 |

Conclusion - investing money in gold for the long term is the most profitable option. Gold grows - profits grow, the dollar grows - the price of your gold still rises. The growth of gold combines with the growth of the currency and gives a good multiplier.

Purchased or gifted – which wedding rings are better?

Most likely, each future wife will want to personally take part in choosing an engagement ring - she will have to wear this jewelry on her finger all the time. For this reason, the issue is most often resolved in favor of purchasing jewelry together with the future husband.

What to do in situations where there are family traditions and it is customary to accept wedding rings from parents? In general, this is acceptable, but under one important condition: the parents from whom the products are passed on must have celebrated their golden wedding. Such symbols will certainly bring happiness to the newlyweds, attract good luck to the family and protect them from quarrels and misunderstandings.

It is unacceptable to accept a ring from a widow, a woman with a difficult fate, from spouses in whose family life there have been infidelities, other tragedies, and troubles. With such jewelry, newlyweds, literally from the first days of their life together, doom their family to trials and negativity.

Pawn shops can get robbed.

Vladimir Morokov : No one is immune from this, especially a credit institution. In Dostoevsky's novel Crime and Punishment, the old money-lender was completely killed. They even rob banks. Unfortunately, our properties have also been subject to robbery attempts.

The pawnshop’s task is to carry out all security measures: install safes, alarms and minimize such actions on the part of criminals.

Credit is micro, problems are macro. How to avoid troubles with microloans Read more

How to buy wedding rings: signs and superstitions

There are several important questions that arise when purchasing jewelry for a wedding. Based on the experience of generations, traditional foundations, signs and superstitions, we can highlight several particularly important issues that future newlyweds will have to deal with before buying rings.

- Who should choose jewelry for a wedding? The bride and groom can make this choice together, but the future husband must pay for the jewelry.

- Can I buy wedding rings separately? This is a bad omen, so you must purchase them in one place, at the same time. They do not have to be identical, but certainly made in the same style. Modern traditions allow spouses to have different jewelry (men often prefer ordinary, smooth items, and women prefer original, unique ones).

- What are the best wedding rings to buy? Traditionally, a smooth surface made of gold is considered ideal for a wedding - it symbolizes the sun, prosperity, and a happy family life (a smooth surface is a symbol of the absence of obstacles on the path of life together).

- Is it possible to buy rings at a pawn shop and have them made to order from existing gold? It is believed that jewelry absorbs the energy of its former owners, so the ideal option for purchasing engagement rings is a specialized jewelry store where you can buy completely new products. It is permissible to make rings to order if the jewelry that will serve as the raw material belonged personally to the future spouses or to a well-known person with a prosperous fate. You should absolutely not purchase wedding rings from pawn shops for obvious reasons: their history and fate are unknown. It’s not hard to guess: people donate jewelry to such places not for positive reasons (forced by need, the item was stolen, found, etc.). What could family life be like with such rings?

Some newlyweds categorically do not accept superstitions, reject traditions and signs, so purchasing and choosing wedding rings is a matter of individual preference.

Buyers buy gold that the client did not take.

Vladimir Morokov : There is no such thing. At the dawn of pawnshop activity, something similar happened; the organizers collaborated with antique dealers and jewelers. But today this is not the case. There are reasons. The number of all valuable things in the hands of the population has decreased. We are obliged to transfer the remaining gold for auction to other authorities.

There was a period of time in the early 2000s when someone was buying unredeemed gold from a pawn shop. Nowadays there are thrift stores for such purchases. Large “gypsy” items—pendants and chains—are in demand.

Article on the topic

The collectors are out. How to put debt collectors in their place?

Pawnshop clients are alcoholics, drug addicts or people with a “dark” past to whom the bank does not provide loans.

Vladimir Morokov : Not true. The main contingent is small entrepreneurs with an average standard of living. They are engaged in some kind of commercial activity. Market traders and farmers are coming to us.

It’s really much easier to get money from a pawnshop than from a bank. Here the procedure is simpler. An entrepreneur brings gold as collateral if he needs money to turn over goods. Large businessmen go to the bank.

Almost half of the regular customers are gypsies. Society doesn’t have a very positive attitude towards them, but most of them are representatives of small businesses in agriculture and livestock farming. I know people who deal with scrap metal and the production of water towers.

People come to pawn gold not only for business, but also on the occasion of funerals and weddings. They celebrate such events with the whole camp.

Gypsies often pawn valuables before the New Year and at Christmas.

These days they organize big feasts and invite all their relatives. Sometimes there is not enough money, so they use the services of a pawnshop. They take large sums, half a million or more.

It happens that gold is collected from all relatives, and these are the ancestral jewelry of grandparents. They gathered in a camp and brought gold, 300 grams, which would be worth half a million. Now gold costs 2 thousand rubles per gram. A gypsy chain can weigh 100 grams.

“This is my great-grandmother’s gold! I honor her memory! - says Duda or Metya - Make sure it doesn’t get lost!”

After a while, they have a financial “exhaust” or transaction, and they take the gold. And so it repeats.

“I even inserted gold teeth into the shepherd dog.” AiF report from the gypsy ghettos Read more

How I bought gold. Stories of an Idiot Investor 3

Disclaimer: This is not an article by a precious metals expert. My material is about how a small private investor thinks when faced with gold.

First, a few sketches.

I recently visited the Diamond Fund exhibition. Haven't been since school. There is a huge collection of ingots and nuggets. Be sure to go, it's truly mesmerizing. Even those who are indifferent to gold.

To get there, you need to stand in a half-hour line at the box office. There are many women, elderly people and tourists from Asia in the queue. During the excursion they stand at the shop windows. I'm a little to the side, studying their faces. The ladies whisper to their companions and ask to buy jewelry. Old people react to the exhibits with loud exclamations. And foreign tourists just stand there with their mouths open.

Another sketch. I was once sitting on a forum. One of the local old-timers was busy buying scrap gold. I used this money to buy one-room apartments. Over the course of two decades, I managed to save up enough for 6 apartments in this way. Interesting strategy. Once a year I go to that forum to visit a colleague. Everything is still the same for him. Calculates the price per square meter in gold, compares the stock market with gold charts, etc. He's clearly having fun and comfortable.

What do these people have in common?

- Blind faith in the value of gold.

- Emotional attachment to the investment object.

- Hobby . They are very similar to numismatists.

- The desire to show off . That is, a demonstration of wealth.

I admit that a few years earlier I, too, succumbed to temptation. And he began to “invest” in gold. But they “caught” me doing completely different things. I stumbled in fear.

What prompted me to buy gold:

- Fears . What if the dollar is abolished? What if there is a war tomorrow?

- Various stories. Return to the gold standard, depletion of gold reserves.

- Absorption of useless literature , which very cleverly disguises itself as investment literature.

Selecting a tool

They changed the firmware for me. All that remains is to choose a storage form.

I chose intuitively and spontaneously. I was in a hurry for some reason. Probably preparing for nuclear winter. Or what were they afraid of then? I do not remember exactly.:)

OMS (an impersonal metal account) was not suitable for me due to distrust in banks and large spreads. We also had to immediately abandon the ingots. Losses of 18% on VAT. The secondary market is scary... suddenly they’ll throw you away.

I was choosing between scrap gold and bullion coins. The crowbar seemed incomprehensible to me. I didn’t really want to meet hucksters and pawn shop workers. I settled on coins.

First I contacted Sberbank.

Saw some crazy spreads there. I started looking for alternatives. It turned out that in Moscow only 2-3 companies are able to provide me with intermediary services - “Derzhava” and “Golden Coin House”. An exciting adventure

I arrived at the “Derzhava” office. Paid in cash. The bearded guy gave me a decent-sized bag. I took him home. The first couple of days I pulled out coins and licked my lips at them. I showed it to my children, friends and relatives.

Then the adventures began. I found forums and communities of eccentrics just like me. There, people in white gloves told interesting things. I will list the most interesting of them:

- When buying coins, no one thinks about storage. As a result, most people keep their homes haphazardly. More advanced ones keep coins in a safe and set an alarm. Someone places it in a safe deposit box. Someone buys a special tube and buries it in the country.

- Under no circumstances should coins be removed from the capsules. The slightest scratch and you will have to throw away the coin with a discount of 10-15% or more.

- No one really explains how to buy gold for a large amount. Even a million dollar bag weighs a fair amount and takes up a lot of space. But what about those who are going to spend a large sum of money?

- Russian coins are not very popular abroad. Therefore, taking out savings “in shorts” in the event of social upheavals and then selling them is not a good idea.

- The favorite story of the “coin-makers” is the spots on the Victorious. This myth has long been debunked. But people still value Moscow coins higher. And they ignore coins produced by the St. Petersburg Mint.

Today those “bitten” by gold took to YouTube.

Here is an example of such a community. Take a look at your leisure. Just be careful with your psyche www.youtube.com/channel/UCfvlB_OW246s7x17RhD-IaQ On my way out

I spent six months in coins. They even went up in price a little. But the fear of losing them (physically) began to become quite annoying.

I decided to sell. Did it without problems. Purchased upon request the next day. The spread wasn't very big. They gave me a piece of paper about the sale.

They didn't really explain the taxes.

It seems they say that they themselves do not report anywhere. But you need to declare profits. I can only note that owning a coin for more than 3 years exempts you from personal income tax. Paper gold

How was it necessary to buy gold in the first place? I turned on logic. I needed to find a tool that would provide the following capabilities:

- Quickly jump out of the metal.

- Own gold with minimal costs.

- Avoid large spreads.

- Owning gold is safe.

- Pay minimal taxes or not pay them at all.

If I had spent at least a month of my life analyzing it, I would never have gotten into “live” metal. The range of tools turned out to be extremely wide:

- FXGD ETF. The simplest and most understandable. Pros: Any investor can buy. Disadvantages: high commissions compared to Western counterparts.

- Gold ETFs from market monsters - IAU and GLD . The most liquid, convenient and inexpensive instrument. Buying is a little more difficult. Either through a US broker or obtain KVAL status.

- Gold mutual funds (Sberbank, etc.). Insane commissions.

- Contract GLDRUB_TOM (1 lot - 10 g of gold). Not very clear to the average person. Not all brokers have it.

- Gold futures. Not suitable for long-term investors.

And so I bought a paper analogue of gold - one of the bourgeois ETFs. I didn’t feel any joy. Why? Yes, because those factors that I mentioned at the beginning of the article have disappeared: emotionality, numismatic passion, faith. No adventures for you. I was left with a line in the terminal and a boring entry in an Excel spreadsheet.

Why is this very good?

Because I returned to the correct state of an investor - the absence of falling in love with my assets. Why this is bad - read below. Reverse flashing

First, I arranged a psychoanalysis session for myself. I wrote out all the horror stories and worked with them:

- What if there is a revolution and a change of system . In this case, I will need cash, a passport and a plane ticket.

- What if banks stop working ? Just look at our history and neighboring countries. In such a scenario, I would also need a solid cache.

- What if there is a war ? Ask the residents of Donetsk. What was valued at that moment? My wedding ring or a year's supply of stew? Think about where and with whom would you exchange your gold scrap?

Then I included the logic:

- Can something that does not generate cash flow be called a full-fledged asset?

- Gold is a hedge against inflation. But stocks and real estate perform the same function. In addition, they can generate dividends and rent.

- Gold is a protective asset in a crisis. A protective asset in the event of a crisis can be either cash or short bonds. And the crisis itself may follow such a scenario that all assets will fall into the abyss.

- Will faith in gold last forever? An entire generation of the gold standard is now dying. Young people generally do not understand what kind of entity this is.

There are no arguments left in favor of gold. I sold it without regrets. And I never returned to this instrument.

Please like if you liked the article.

Don't agree with the author? Throw tomatoes at him in the comments.

And subscribe to the most fun telegram channel “Retire at 35”

A pawn shop can replace gold jewelry with a fake one.

Vladimir Morokov : No, of course, this is criminally punishable, and technically difficult to carry out. It happens that they try to sell a fake, but such numbers do not work. Recognizing gold is not that difficult, and a pawnshop employee has these skills. Diamonds are more difficult to distinguish from real ones, since today they have learned to grow diamonds artificially.

There was a comical story in my practice.

A young couple came, recently married. They pawned the ring, most likely, in order to make some kind of profitable purchase. I took it myself. The jewelry was rich, with a diamond, as it turned out later, the mother gave it to her daughter.

The next day the mother herself came running, bought the ring and started a scandal.

“All the crooks work in pawn shops, you dig out diamonds! You changed the stone for me!” - she said.

I suggested that she measure the diamond with a caliper and compare it with the document. But the woman was in an emotional state and did not agree:

“The stone was small and shiny, but here it is big and dull, you changed the small one to the big one!”

It is easy to make sure that the stone is removed and a new one is installed. Any jeweler can determine with a 100% guarantee whether the stone was removed or not. I suggested going to a jeweler for an examination. But I was never able to convince her that the ring was real. He advised me to contact the police.

Signs of credit institutions can be found in any city in Russia. Photo: AiF/Vitaly Kolbasin

Pawn shops buy stolen gold.

Vladimir Morokov : This happens for objective reasons. A pawnshop employee will not take gold from suspicious individuals, this is at his own loss. But there are still such precedents. The defendants are mostly young people with no experience. Anyone who trades seriously is unlikely to come to us to hand over stolen goods, because you need to provide a passport, and there are video cameras in the room. This is stupid because law enforcement will figure out the culprit.

If we receive a stolen item, it must be returned, and the company suffers financial losses. Therefore, of their own free will, no one tries to get involved with stolen goods.