Ours offers qualified services for customs clearance of precious metals and jewelry, precious and semi-precious stones, including costume jewelry. Thanks to the rich practical experience and high professionalism of our company’s employees, we carry out prompt customs clearance of precious metals or jewelry when importing, importing into the Russian Federation or “customs clearance” for export when exporting from the Russian Federation as quickly as possible, extremely competently and at reasonable prices.

We work with any participants in foreign trade activities:

- Individuals

- Legal entities

- Individual entrepreneurs

We provide customs clearance services for precious metals and jewelry at any customs office in the Russian Federation!

We carry out prompt customs clearance: “customs clearance” or “customs clearance” of any jewelry, precious metals, stones and costume jewelry at any customs office in Russia - every day!

The main positions processed by our company:

- Jewelry and adornments: earrings, rings, wristwatches; pendants; brooches; bracelets; necklaces; hairpins; cufflinks

- Precious stones: diamonds, diamonds, sapphires, rubies, emeralds, alexandrites.

- Semi-precious stones: peridot, turquoise, garnet, topaz, spinel, amethyst, aquamarine, beryl, tourmaline, zircon, hyacinth, opal, moonstone, rock crystal, quartz, amber, coral.

- Precious metals: gold, silver, platinum.

- Jewelry:* earrings, rings, watches; pendants; brooches; bracelets; necklaces; hairpins; cufflinks

- Other: men's or women's watches with serial numbers.

- And any others not listed in this list.

* — jewelry made of glass and metal is cleared at excise customs, excluding those made of plastic or wood, without precious and semi-precious stones, which is cleared at regular customs.

Who can import precious metals and jewelry into Russia??

- individuals (moving goods for personal use, not commercial parties);

- legal entities and individual entrepreneurs (in any quantity and volume).

Features of customs clearance of jewelry and precious metals by individuals

Individuals may import precious metals and jewelry for personal consumption only. Only legal entities and individual entrepreneurs can import jewelry, precious metals and stones intended for commercial use.

The following do not apply to goods for personal use:

- natural diamonds;

- precious metals or stones, if their customs value is more than $25,000.

The following cannot be imported in international postal items (IPO):

- precious stones in any form and condition;

- natural diamonds, excluding jewelry.

Goods prohibited for export by individuals:

- raw precious metals;

- scrap and waste of precious metals;

- ores and concentrates of precious metals and commodities containing precious metals.

Jewelry import standards for individuals in 2021

Current restrictions on the weight and value of imported goods.

| Restrictions on imported goods | ||

| Import method | Weight restrictions | Cost restrictions |

| By air (accompanied by luggage) | no more than 50 kg | no more than 10,000 euros |

| Other modes of transport, including on foot (accompanied by luggage or through a carrier) | no more than 25 kg | no more than 500 euros |

If the value or weight of the goods exceeds the permissible limit, then for the excess you will need to pay a customs duty in the amount of 30% of the value exceeding the norm, but not less than 4 euros per 1 kilogram of weight.

Restrictions on the weight and value of goods delivered by express carrier or sent by international mail (IPO). From 2021, these restrictions are imposed on each parcel.

| Restrictions on postal items (MPO) and goods delivered by express carrier | |||

| Validity | Weight restrictions (gross) | Restrictions on the cost of goods | Unified rates of customs duties |

| From January 1, 2021 | no more than 31 kg | no more than 200 euros | 15% of the cost, but not less than 2 euros per 1 kg of weight in terms of excess |

If the value or weight of the goods exceeds the allowable limit, then for the excess you will have to pay a customs duty of 15% of the value exceeding the norm, but not less than 2 euros per 1 kilogram of weight.

Where can individuals clear customs jewelry, costume jewelry, and precious metals?

Customs clearance of accompanied baggage must take place at specially equipped checkpoints:

- at airports

- in seaports

- at automobile checkpoints (MAPP, DAPP)

- at railway checkpoints

- at the warehouses of express carriers (UPS, DHL, FedEx, EMS and others)

What does gas have to do with it?

Sales of Russian gold abroad for the first time exceeded the volume of gas exports, and revenue for the sale of 66.4 tons of the yellow metal in April-May alone amounted to $3.58 billion. This is a fact that some experts interpret not entirely correctly, but at the same time it is clear. The export of gold from the country is discussed as a negative event, and the export of gas and oil is perceived, as usual, as a panacea for all coronavirus ills and the salvation of the country’s budget.

Managing partner of the analytical agency WMT Consult, Ekaterina Kosareva, insists that it is necessary to separate the wheat from the chaff, and the gas from the gold. “The facts that the volume of gas exports in dollar terms has decreased, and gold has increased, have different cause-and-effect relationships. Moreover, income from the sale of gold will never be able to compensate for losses from the coronavirus crisis and are not intended for this,” Kosareva said.

Golden time

Engraving of a gold bar of the highest standard 99.99% purity at the Krasnoyarsk Non-Ferrous Metals Plant named after V.N. Gulidova

Photo: RIA Novosti/Ilya Naimushin

According to the expert, the drop in gas exports in dollar terms is due to the linking of gas prices under long-term contracts to the oil basket, but, as is known, at some point oil prices on the stock exchange even became negative; with the shutdown of production, quarantine measures taken around the world, and the global recession. “Demand fell naturally, but all these are short-term phenomena, and the fundamental picture of the global gas market will not change,” says an analyst from WMT Consult.

This idea is confirmed by independent reports from the International Energy Agency. According to IEA estimates, global gas consumption is growing by an average of 1.8% per year and will grow by 1.5% in the next five years. Analysis of demand across all continents shows stable growth potential and priority in favor of blue fuel. Gas is a raw material for the needs of petrochemicals, for example, in the production of polymers and other complex hydrocarbons of high value, and LNG is a young and promising direction for the work of gas companies around the world without being tied to a pipe. Demand for gas will only grow over time.

“For gold miners, the 1990s were a quieter time than now.”

Ex-CEO of Petropavlovsk Pavel Maslovsky talks about a corporate conflict in a gold mining company

Jewelry customs for legal entities and individual entrepreneurs

Specialized customs houses of jewelry, precious metals, costume jewelry, precious and semi-precious stones where customs clearance can be carried out: customs clearance or their customs clearance, limited to several customs points (SVH).

| Places of declaration when importing precious metals and precious stones | ||

| N p/p | Customs authority code | customs Department |

| 1 | 10009130 | Specialized customs post of the Central Excise Customs in Moscow |

| 2 | 10130010 | Vashutinsky customs post of the Central Excise Customs Moscow region, Khimki |

| 3 | 10009190 | North-Western excise (specialized) customs post in St. Petersburg |

| 4 | 10009230 | Smolensk excise customs post Smolensk region, Smolensky district, Stabna village |

Necessary payments for customs clearance of jewelry

When clearing jewelry through customs, you must pay customs payments: duty, fee, VAT, excise tax. The basis for their calculation is the customs value of jewelry, which includes both their invoice value and transportation costs. In this case, depending on the country of origin of the goods, preferences may be provided.

| Name | HS code | Duty | VAT | Excise tax |

| Natural pearls | 7101100000 | 10% | 20% | — |

| Cultured pearls | 71012….. | 10% | 20% | — |

| Unsorted diamonds | 7102100000 | 15% | 0% | — |

| Industrial rough diamonds | 7102210000 | 10% | 0% | — |

| Other industrial diamonds | 7102290000 | 15% | 20% | — |

| Non-industrial rough diamonds | 7102310000 | 0% | 0% | — |

| Other non-industrial diamonds | 7102390000 | 10% | 20% | — |

| Unprocessed precious and semi-precious stones (jades, rubies, sapphires, emeralds, alexandrites, others) | 710310000 | 10% | 20% | — |

| Raw precious and semi-precious stones (rubies, sapphires, emeralds) | 710391…. | 12% | 20% | — |

| Unprocessed precious and semi-precious stones (jade, alexandrite, others) | 710399…. | 15% | 20% | — |

| Silver bars containing at least 999 parts of silver per 1000 parts of alloy | 7106910001 | 12,5% | 20% | — |

| Gold bars containing at least 995 parts gold per 1000 parts alloy | 7108120001 | 12% | 20% | — |

| Platinum bars containing not less than 999.5 parts of platinum per 1000 parts of alloy | 7110110001 | 12% | 20% | — |

| Waste and scrap of precious metals or metals clad with precious metals; other waste and scrap containing precious metal or compounds of precious metals, used primarily for the recovery of precious metals | 7112…… | 0% | 20% | — |

| Articles made of silver, whether or not plated, clad or not clad with other precious metals | 7113110000 | 10% | 20% | — |

| Products of other precious metals, whether or not plated, clad or not clad with precious metals | 7113190000 | 10% | 20% | — |

| Articles made of silver, whether or not plated, clad or not clad with other precious metals | 7114110000 | 15% | 20% | — |

| Products of other precious metals, whether or not plated, clad or not clad with precious metals | 7114190000 | 11% | 20% | — |

| Costume jewelry with or without galvanic coating of precious metals | 7117…… | 3 euro/kg | 20% | — |

| Coins (other than gold) that are not legal tender | 7118100000 | 20% | 20% | — |

| Other coins | 7118900000 | 20% | 20% | — |

Transportation Features

The international transport of precious metals is subject to strict regulations. They are quite strict. Thus, the carrier’s responsibilities include:

- selection of special vehicles with a high level of safety;

- use of the services of those organizations that have permission to transport this type of cargo;

- providing armed security for cargo.

Note! The absence of armed guards entails criminal liability.

At the same time, alloys that contain a small percentage of precious metals (up to 5%) can be sent by train, and if the content of precious impurities is less than 1%, then the importer is free to choose a vehicle.

State control act when importing jewelry into the Russian Federation

According to Order of the Ministry of Finance of the Russian Federation dated September 17, 2001 N 249, state control is carried out when importing jewelry, precious metals, precious and semi-precious stones into Russia. Based on its results, inspectors of the Russian State Assay Office draw up a State Control Act. This document reflects the compliance of the imported product with the data specified in the accompanying documents (name, quantity, weight, etc.). In addition, if there are no violations, the controller will make a note: “the presented product is recommended for further customs clearance.” If there are violations, it will be written: “the presented product is not allowed for further customs clearance,” and the materials will be transferred to law enforcement agencies. Every piece of jewelry is subject to inspection. The resulting Certificate must be submitted to customs along with the Customs Declaration.

Customs clearance errors

Errors during customs clearance of precious metals are unacceptable. Any typo can cause significant problems, including criminal liability. Therefore, before submitting the customs declaration, it is necessary to carefully check all the information. Customs clearance of this type of cargo is specific, control at each stage is very strict.

We know how complex and problematic customs clearance can be, and therefore we strongly advise you to contact us if you lack knowledge. We have many years of experience in customs clearance of the relevant category of cargo; we will help you prepare permits and other accompanying papers.

It is no secret that customs inspection of precious cargo can take a long time, since this is a responsible process. By contacting us, you can be sure of prompt clearance and no problems, because we know all the nuances of the legislation and take a responsible approach to preparing customs clearance. Force majeure circumstances are excluded. In any case, we take full responsibility for the customs clearance process. Call us by phone or email us [email protected]

How are precious metals and stones valued?

During customs clearance of jewelry and customs clearance of precious metals, you should understand how and in what quantities the weight of precious metals and stones is measured in a particular country. Most countries use metric units, which primarily measure weight in grams and milligrams. But there are also countries that use other measures of mass.

In the UK, USA and other countries that use the English system of measures, the weight of precious metals is measured in troy pounds and its divisions (the most common division of the troy pound is the troy ounce):

- 1 troy pound = 12 troy ounces = 373.2418 g;

- 1 troy ounce = 20 penny weights = 31.1035 g;

- 1 pennyweight = 24 grains = 1.5552 g;

- 1 grain = 20 maytam = 64.7989 mg;

- 1 mayt = 24 doytam = 3.2399 mg;

- 1 doyt = 0.13499 mg.

In India and Pakistan, measures such as chattak and tol are used:

- 1 chattak = 5 tolam = 58.319 g 1 tola = 11.664 g

In Japan, momme is used:

- 1 momme = 3.75 g.

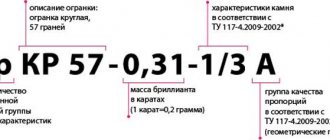

If you have to clear customs jewelry or precious stones with precious stones, you need to have an idea of such a measure as carat. When measuring gemstones, either the metric carat or the English carat is usually used as a measure of mass:

| Unit | Metric (milligram) | English (milligram) |

| 1 carat | 200.000 | 205.000000 |

| 1/2 carat | 100.000 | 102.500000 |

| 1/4 carat | 50.000 | 51.250000 |

| 1/8 carat | 25.000 | 25.625000 |

| 1/16 carat | 12.500 | 12.812500 |

| 1/32 carat | 6.250 | 6.406250 |

| 1/64 carat | 3.125 | 3.203125 |

When measuring the weight of pearls, the carat gran (this is a quarter of a carat) is used.

Probably everyone knows the old Russian proverb “the spool is small, but dear.” It owes its origin to such an old Russian unit of weight as the spool.

Here are all the ancient measures used since ancient times in Rus':

- fraction = 44.435 mg;

- spool = 96 shares = 4.2658 g;

- pound = 96 spools = 409.517 g.

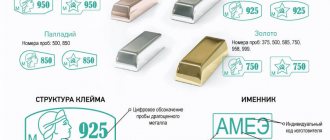

For customs clearance and measurement of precious metals in alloys (ingots, coins and other products), the metric and carat sample systems are used.

With the metric system of samples, the content of pure precious metal is determined by the number of its units in 1000 units of ligature weight, with the carat system of samples in 24 units. Until 1927, in the USSR, as well as in pre-revolutionary Russia, a spool sampling system was in effect, in which the content of precious metals was determined by the number of spools per pound of ligature weight (1 pound = 96 spools).

Gold in the form of high purity bars (899 and above for the USA and 955 and above for France and England) is known to be used in international payments between states.

Known sampling systems for precious metals and their ratios

| Metric | Carat | Zolotnikovaya |

| 1000 | 24 | 96 |

| 916 | 22 | 88 |

| 833 | 20 | 80 |

| 750 | 18 | 72 |

| 583 | 14 | 56 |

| 500 | 12 | 48 |

| 375 | 9 | 36 |

Precious metal samples used

| Silver | Gold | Platinum | |

| Russia, before 1927 | 84,88 | 56, 72 | — |

| Western Europe, before 1945 | 800 | — | — |

| Modern domestic | 750, 875, 916 | 375, 583, 958 | 950 |

| Modern foreign | 900, 925 | carat 9, 14, 18, 22; metric 333, 585 | — |

If you are ever faced with the purchase and customs clearance of unique Faberge products, then it will be useful for you to have an idea of all the known hallmarks of the craftsmen of this eminent manufactory (the hallmark carries basic information about the origin of the jewelry, and is also the main guarantee of its quality) :

KF, SF, VA, FA, JA, AG, AN, EK, AM, AN, GN, MP, OR, IP, HW, WR, TR, FR, VS, AT, SW, ES

How to choose a HS code

First, you need to determine the code of the commodity nomenclature of foreign economic activity by calculating the percentage of precious metal in the product. Then select a product code in accordance with the name of the product, its membership in certain groups and sections.

In order for a product to be called a precious metal, it must contain at least two percent of it. Such goods belong to group 71 of the Commodity Nomenclature of Foreign Economic Activity . Each group is divided into appropriate classifications. They depend on how the metal was processed.