If you want to save for old age, but are afraid of the unknown future, invest in gold. No matter how reliable stocks and bonds are, it is always better to play it safe. For the last six thousand years, gold has been the universal equivalent of money. In the next hundred, it’s unlikely that anything will change. This article is about where to buy gold, how to avoid counterfeits and how much it costs.

Since 1998, the price of gold has increased in rubles by 5000%. This was facilitated by the global crisis of 2008 and the anti-Russian sanctions of 2014. When the economy is unstable, people begin to hedge and buy more precious metals. There is a suspicion that there will be more crises in the future, which means we need to prepare for them.

Gold is a universal currency. During a crisis, no matter personal or global, you can always exchange precious metal for something more important.

For Russians, buying gold reduces the risk of ruble depreciation, since the value of the precious metal is tied to the value of the US dollar. That is, when you invest in gold, you also invest in US dollars.

In January 2014, ₽1,300 could buy either one gram of gold or $39. Whatever you choose then, the result would be approximately the same: +100% on your investment. This is due to the rise in price of the dollar, and not to gold as a metal.

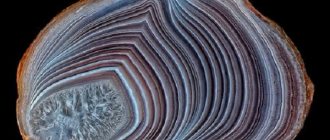

Gold and dollar price charts since 2014. Source: Central Bank of the Russian Federation

Buying physical gold - not opening a deposit, not investing in an impersonal metal account, but buying metal and putting it in a safe - is not as simple as it seems. We have identified three main methods and listed the advantages and disadvantages of each.

Gold scrap

You haven't realized it yet, but you may have been investing in gold for a long time. Carry out an audit in the house: grandmother's earrings, mother's rings, chains and signets, as well as raw and non-standard gold - this is scrap gold. It's better to save it for a crisis. But first, check the authenticity and estimate the cost.

The best means of verification is X-ray fluorescence analysis. The analysis device is called a spectrometer. Using X-rays, he shows the composition of a metal product on a screen. You can put a coin, an ingot or a pile of metal into such a spectrometer: the device will show the exact amount of gold in the product.

You can find such an installation in bank branches specializing in precious metals, jewelers and archaeological museums. The service may be paid, but banks usually do not charge their clients a fee.

Where can I buy

. In pawnshops, antique and jewelry stores, gold is usually sold as jewelry: you are buying not only the metal, but also the work of the jewelers.

In addition, the price may include VAT. Therefore, buying scrap gold just for investment is unprofitable. On the other hand, when purchasing jewelry or receiving it as a gift, you are simultaneously investing in gold and receiving a beautiful thing.

How to sell.

Scrap prices can be found on the websites of gold buying shops. But in any case, the sale will not be very profitable. Unlike big banks, for salons and other gold buyers, buying and selling scrap is the only way to generate income. And they set prices in their favor.

We do not recommend buying “from hand”: this is prohibited by law, and for good reason - there is a high probability of paying for fake gold.

Gold bars

The bars are inexpensive, protected by the Central Bank and allow you to hold real 999 gold in your hands for ₽5,500. It is not profitable to invest large sums in gold bars due to taxes and markups, but as a first symbolic step towards a carefree retirement, this method is suitable.

Where can I buy

. Gold bars are sold in banks. It doesn’t matter where exactly to buy gold. The Central Bank monitors order: if they sell you a fake, the bank will have problems.

When purchasing, you must have your passport with you. And the bank must issue you a certificate for gold - it confirms the quality of the bullion. The certificate number must match the number on the bar. Also, upon purchase, you should be given a receipt and a clean, undamaged gold bar in packaging. When purchasing, VAT is added to the price of the metal.

When you receive the bar, do not remove it from the packaging. Gold is a soft metal and can be easily damaged. And when sold for a “non-marketable appearance”, the price will decrease. You can also leave the bullion in the bank for paid storage.

Types of ingots.

Ingots are divided into measured and standard. Measured are 999 fine ingots, weighing from 1 to 1000 grams. The production of such ingots is regulated by state standards.

All numbers and letters of stamps with the manufacturer's numbering on the bars must be clearly visible. In appearance they are even, smooth, solid, without scratches, cracks or chips.

Standard gold bars are produced according to interstate quality standards. They are 99.95% gold pure and weigh 11-13.3 kg. This product complies with the state standard dating back to the times of the USSR. Markings on the large base of each standard bar include: number, grade of gold, hallmark information, exact weight, year of production, country symbol and manufacturer's mark.

The less a gold bar weighs, the more expensive it is. This is due to manufacturing costs: it is cheaper to make one large ingot than several small ones. Compare: in September 2021, at Sberbank, 1000 one-gram gold bars cost ₽3.285 million, and one kilogram - ₽2.993 million. The difference is 9.76%. With gold, as with everything: when you take a lot at once, it turns out cheaper.

How to sell. A gold bar can be sold to any bank that has permission to deal with precious metals.

When selling an ingot, the bank needs to provide the certificate that you were given upon purchase, and the gold itself in the package. It must be undamaged, otherwise they will buy it from you at a big discount.

The check will come in handy when you need to pay personal income taxes. He will confirm who exactly bought the gold and at what price.

You can sell the bullion to a pawnshop without accompanying documents. True, the price per gram will be lower. Keep in mind that they have been asking for your passport lately.

Selling gold to a neighbor yourself or through an online ad is not the best option if you are not a jeweler and do not have a license to deal with precious metals. Such trade is illegal: at best, you face forced labor, at worst, prison and a huge fine.

It is convenient to look at prices for precious metals in different banks on the Investfunds website

General information about gold bars. What types of gold bars are there?

click to enlarge

One of the most expensive and rare metals on Earth is gold. It is mined in the form of impurities from other metals, and only occasionally pure nuggets are found. Miners have to mine and wash tens of tons of rock in the most difficult conditions for the sake of several hundred grams of precious metal. Also, an admixture of gold can almost always be found in copper and silver. However, there are many other expensive and rare metals, so why has gold become so popular?

Gold is valued not only for its beauty, but also for many other positive properties. Gold does not oxidize or tarnish, is an excellent conductor and is used in medicine. The main thing here, of course, is resistance to acids - it is thanks to this that we have the opportunity to enjoy the sight of golden works of art, which are thousands of years old. Due to its unique antiseptic properties, it is added in small quantities to medications. Helps in the treatment of arthritis, lupus and other diseases. However, if we ignore the useful qualities and turn to history, we can see that gold is one of the first metals mined by man. But it was not possible to use it anywhere - it was too soft. And only thanks to its beauty it began to be used to create all kinds of jewelry, and subsequently money. But, despite its apparent softness, gold is one of the densest metals - more than a kilogram of metal can fit in a five-centimeter ball.

However, despite all its useful qualities, the main field of use for gold is still trade relations. You can buy it in the form of special coins or bars

, sold at any major bank, which is an excellent type of investment. States disappear, money depreciates, but gold never completely loses its value. There are many known cases in which gold savings saved people's lives - in besieged Stalingrad, jewelry was exchanged for food, and captured Jews, giving away all their savings, saved themselves and their families from concentration camps. But let's hope that we will never need it again for such purposes. At its core, gold is the hardest world currency - in almost any country it is relatively easy to exchange it for local money. Of course, in this case, some part of the initially invested amount may be lost, but a person will never find himself empty-handed. It’s not for nothing that in Muslim countries women wear all the jewelry on themselves - an ex-wife kicked out of the house by her husband will always be able to feed herself.

This type of financing is especially effective in the context of the current instability of the economy and exchange rate - the money invested can fall in price by almost half, a striking example of which is the recent financial crisis. However, encyclopedic knowledge about gold alone will not be enough

– you need to know well the features of the gold market not only in Russia, but also in other nearby countries. So there is an opinion that in Turkey you can buy gold much cheaper. And this is true, if its quality does not play a decisive role, such a precious metal is not suitable for investment. Unlike Russia, in Turkey there is no precisely designated karat system, thanks to which each company selling gold has the opportunity to take full advantage of its imagination - gold of the highest standard purchased there from us can, at best, turn out to be “average”. Also in the markets there is a high percentage of counterfeits made from all kinds of alloys, and in state stores the prices are not much different from ours. In addition to the purity of the gold itself, the taxation system plays an equally important role, which can amount to up to 20% of the price of the bullion. Thus, in Russia a VAT of 18% is charged, which is not refundable when gold is sold.

In addition to gold, silver, rhodium, osmium, platinum, palladium and others are also considered precious metals. It is worth understanding that a gold bar is not at all the same as a steel bar. And the point here is not only the accuracy of the weight - a special stamp is placed on each gold bar, which indicates the weight, purity and number of the bar. There are two types of gold bars – standard and measured. They are produced in refineries where production is under strict control. They are required to comply with all standards established in the Russian Federation. Bullion is also produced for trade with other countries, for which completely different standards apply, established by the London Gold Merchants Association, which dominates the market for the purchase and sale of this precious metal. If an ingot violates any standard, it is immediately sent for remelting. So, what is the difference between measured and standard bars?

Measured gold bars

On the territory of Russia, gold in such bars must be practically pure - from 99.99% pure precious metal. They are produced in different sizes - from 1 gram to a kilogram. They are the most affordable way to buy gold in banks. As with any other product, there are certain standards for precious metal bars:

- The maximum permissible error in mass is indicated, as well as the nominal length and width of the ingot. Oddly enough, the thickness is not indicated anywhere.

- The surface of the ingot must be absolutely clean - if grease stains, scratches, chips and other damage are found, its price will drop, so they should be stored extremely carefully.

- Despite the significant rigidity of some standards, the sides of the ingot may have a wavy or curved surface.

- Each ingot must be clearly marked. Letters and numbers must be uncorrected, clearly visible and not merge with each other. It is applied to the front side and must include the inscription “Russia”, weight in grams, name of the metal, total amount of precious metal, trademark and serial number of the ingot.

Also, each bar, regardless of size, is accompanied by a certificate from the manufacturer, which records the production date, fineness, type of precious metal, number and other data. Thanks to the unique number, it is easy to trace the history of the purchase and sale of any bullion ever produced. And even if the certificate is lost, you can always use the data indicated on the label. Moreover, each of the factories has its own numbering method, so identifying the manufacturer will be no less easy. The size and shape of the ingots, although indicated in advance, can be changed at the request of the customer.

Standard gold bars

And if marked bars must have increased purity and weight accuracy, with standard bars everything is somewhat simpler. So the sample must be at least 99.95%, and the alloy mass can fluctuate more freely (alloy mass is understood as the total mass of the ingot, taking into account impurities). Factories producing such ingots strictly adhere to GOST standards:

- A standard gold bar should weigh no less than 11,000 grams and no more than 13,300 grams.

- They are required to have the shape of a regular truncated pyramid, however, refineries have the right to deviate from this norm at the request of the customer.

- The amount of precious metal in an ingot is indicated according to officially approved standards.

- As with measuring ingots, the surface must be free of any stains or damage, however, the presence of cleaned areas is allowed, the depth of which does not exceed 1 mm, and the concavity should not be more than 5 mm.

- On the larger base there should be a marking indicating the production date, ingot number, state symbols, etc.

also differ

. Of course, stamped ingots look more attractive, because their surface is perfectly smooth. This effect is obtained due to pressure on the metal in a heated state, however, production requires the use of high technologies, which is why the cost increases, which nevertheless does not make them less liquid. The weight of such an ingot rarely exceeds half a kilogram.

Ingots produced by casting do not look as presentable and are cheaper, occupying an average price position. Their weight also does not exceed 500 grams. The cheapest of all existing ones are powder ingots. Using electrolysis, gold dust is combined with each other and given the desired shape. However, it is difficult to find such an ingot in Russia, because They are not produced in our country.

Having decided on the types of existing bars, it is worth paying attention to ways to identify counterfeits. Unfortunately, it is not possible to try the ingot “by the tooth” - after that it can sharply lose in value.

How to determine the authenticity of a gold bar?

- The simplest solution would be to take the bar to a jeweler - he will easily carry out the necessary measurements and analyzes and give an accurate answer. If this option does not suit you, you can try the following points.

- Drop iodine or vinegar onto the surface. There will be nothing wrong with the gold, but there will be a spot on the fake. However, in this way you can only check the outer part of the ingot, and it is not possible to recognize the sample.

- Study the mark carefully. It should contain all the necessary information. So, Soviet ingots depict a hammer and sickle or a woman in a headscarf.

- Following Archimedes' law, it is easy to calculate the exact volume of the ingot.

- If the check must be quick, the following method is used - a gold item is passed over the touchstone, leaving a mark on it. Then next to it the same action is repeated, but with a reference sample. After this, they are passed over them with a stick soaked in acid - the darker the trace remains, the more impurities there are in the gold.

You should only buy gold from reliable places.

Even if your knowledge about gold is not limited to the information in this article, it is best to contact banks and not believe tempting offers. Thus, scammers can simply pass off pyrite as a precious metal - they are very similar in appearance and at first glance it is extremely difficult for the average person to tell the difference.

As mentioned above, in Russia, when purchasing gold, a commission of 18% is charged.

, which makes the purchase financially unprofitable. However, in other countries, the taxation system is more accepting of gold purchases, which will save a considerable amount of money. First of all, you should pay attention to Switzerland, the United Arab Emirates and Singapore. However, there is one thing - for such a purchase to be truly profitable, the amount of gold purchased must be more than significant - it is worth taking into account the cost of air tickets and all kinds of banking services.

You should not trust the purchase of gold to intermediaries

, and even more so to conduct it via the Internet - there are many fraudulent sites, using which you will, at best, receive less gold, or even lose all the money you paid. The same applies to personal acquaintances - trust is inappropriate in financial matters. Of course, you won’t immediately guess anything - fictitious bars can be stored in a safe deposit box in a very real bank. It has gotten to the point where scammers are offering to make payments using WebMoney.

Related materials:

- Counterfeit money - how to spot it?

- Popular misconceptions about money

- Gold hallmarks - what does a hallmark on a gold product mean, what hallmarks are there?

- How to invest in gold?

Golden coins

This is where investors invest their money. It is from them that a family pension fund is established. Such a fund is formed over the years from proven and high-quality gold. This is the only material used to mint investment and collection coins. The Central Bank of Russia is responsible for the authenticity of the coins; they can only be purchased through banks, and they are also exempt from VAT. What you need for long-term investment.

Types of coins. Gold coins are divided into two categories: investment and collectible. They vary in price.

Investment coins are as close as possible to the value of pure gold, are issued in large quantities and are valued for their high purity: at least 900.

The only investment gold coin that is constantly printed in Russia is called “St. George the Victorious.” The rest are produced on occasion and in limited editions. For example, “Sochi 2014” is also an investment coin, but it was issued once, especially for the 2014 Olympics.

Collectibles - sold at a premium for rarity. They are issued in a limited edition, the coin depicts an artistic design in honor of an anniversary, a famous person or a hero city.

Where can I buy.

Gold coins are sold in banks. They get there from the Mint through the Central Bank. The Central Bank determines the price of the coin, which consists of the cost of gold on the London interbank market and a markup for minting - 7%. Banks add 3% to 10% to the Central Bank price to make a profit.

Before purchasing, always look at the quotes on the Central Bank website and compare with the selling price in banks. Wherever it’s cheaper, buy it there. There are no risks in this approach: both Sberbank and Rial-Credit have gold of the same quality - from the Mint. The only difference is the markup.

To purchase a coin from a bank, you will need a passport.

The coin is sold packaged in a plastic container. You shouldn’t open it: even fingerprints will greatly reduce the price when selling. Banks buy coins in poor condition, especially if they sell them. The only question is the price. If the type is not marketable, then the discount is large.

Don't throw away your receipts. They will come in handy if you sell the coin for a profit and fill out an income tax return.

How to sell.

First, try to sell the coin back to the bank: this way you will receive a 7% markup for minting, which was originally included in the price.

If the bank offers you a low price, sell it as scrap: find out the exact value of the gold on the day of sale and compare different buyers to find the best price.

Ingot standards for the whole world

A well-known example of precious metal bullion is the London Good Delivery, which means “safe bet” in English. It has been approved by the LBMA (London Bullion Markets Association) and LPPM (London Palladium and Platinum Market).

Photo: Pixabay/flaart

In the vaults of the central banks of most countries there are classic Good Delivery bars. Their traditional weight is 400 troy ounces, or 12.4 kg. And they are traded in all the main international centers for the sale of this precious metal: London, New York, Zurich, Hong Kong, Sydney and Tokyo.

Table 1. Requirements for 995 gold bars

| Names of standards | Units | Values |

| Weight | t oz | 350-450 |

| G | 10 886-13 754 | |

| Dimensions | mm | |

| length of the larger base | 250 (+/- 40) | |

| width of larger base | 70 (+/- 15) | |

| thickness (height) | 35 (+/- 10) |

Source: inzoloto

Acceptable beam bevels: 7-15% in length, 15-30% in width.

The following is imprinted on the outer surface:

- manufacturer's mark;

- weight;

- purity (sample);

- serial number;

- year of creation.