Commission trading benefits both buyers and sellers. You can organize such a business in specialized stores or other retail outlets; there are no restrictions on this matter. In order for the activity to be carried out legally, the entrepreneur must declare the correct OKVED code “Commission trade” during state registration with the tax service.

Read also: Is it possible to carry out activities without OKVED

Commission trading concept

Commission trading means trading activities in which the relations of the parties are regulated by a commission agreement. At the same time, the seller sells goods transferred to him for sale by other persons. The participants in such relations are:

- principal (gives instructions to conclude purchase and sale transactions for a fee);

- commission agent (seller who carries out accepted orders for a certain percentage - commission).

New and used (used) non-food products, antiques, and art objects are accepted for commission. In addition, the commission can accept confiscated and ownerless property, as well as that which, by a court decision, became the property of the state.

OKVED - Other wholesale trade - decoding

And yet it is necessary to keep records, collect taxes, and control the activities of commercial enterprises and small entrepreneurs. Therefore, the All-Russian Classifier of Economic Activities was created, which included this area. But, I must say, it is quite difficult to combine everything into one system, because goods are divided into groups, entrepreneurs into activity profiles. However, there is a special subsection in the new OKVED 2021 - other wholesale trade. What this means and who can use codes from this subclass will be discussed below.

This section is so subtle and ambiguous that, on the one hand, many enterprises and individual entrepreneurs, whose range of products includes more than several dozen items, can be attributed to it, and on the other hand, the slightest mistake will lead to fines and negative aspects. After all, it is still not entirely clear what formula is used to calculate the ratio of types of goods and how to make sure that they are all in equal shares. The question remains regarding the permissible excess of this figure in percentage terms. If, for example, an organization sells absolutely any goods, for example, like the well-known AlI Express, but at some point on the website of one of the product lines there is a couple or three percent more, will this be considered a violation of the law? So everyone will have to deal with other wholesale trade in OKVED 2 on their own.

What will be the OKVED encoding “Commission trade” in 2019

The OKVED code “Commission trade” in 2021 must be taken from the current edition of the OKVED2 directory (approved by Rosstandart, order No. 14-st dated January 31, 2014, as amended on July 10, 2018). The official name of this classifier is “OK 029-2014 (NACE Rev. 2)”. The OKVED2 directory is very convenient to use, since similar types of activities are grouped in it into separate sections.

The OKVED code “Commission trade in non-food products” is selected as follows:

- We are looking for section “G” (wholesale and retail trade).

- We move to class “47” (wholesale trade, except motor vehicles).

- Next, we move to subclass “47.7” (trade in specialized stores of other goods).

To trade used goods, select the required code in the “47.79” group. This group includes activities related to retail trade:

- antiques (47.79.1);

- second-hand books (47.79.2);

- other used goods (47.79.3);

- activities of auction houses (47.79.4).

Group 47.79 does not include some types of commission trading. These are the following types of activities:

- sale of used cars (code 45.11);

- thrift store services (code 64.92);

- services of online auctions and other auctions (code 47.91, 47.99).

You can select several OKVED codes. But only one of them will be primary, and all other encodings will be additional. When registering with the Federal Tax Service, in a special application you must indicate the type of activity code, which will consist of at least 4 digital characters.

OKVED code 2

— production of products from the main components of an alloy of precious metals, such as: tableware, cutlery and utensils, toiletries, office and writing instruments, items for religious ceremonies, etc.;

— production of technical or laboratory products from alloys, including precious metals (except for tools and their parts): casting molds, spatulas, trays with a layer of metal applied by galvanic method, etc.;

We recommend reading: When will certificates for young families be issued 2021 in Bashkiria

Commission trade in clothing

Trade in used clothing is in very high demand among the population. An item that is unnecessary for one person may be a necessary acquisition for another. Sometimes in such stores you can buy high-quality and rare (unique) things.

If you decide to open your own store for such trade, the following OKVED codes “Commission trade in clothing” will suit you:

- “47.79.3” – trade in other used goods;

- “47.71” – sale of clothing in specialized stores;

- "47.72" - sale of shoes.

How to sell souvenirs according to OKVED

- 44.2 - subclass, which is used in cases where wholesale trade occurs between the supplier and buyer of ceramics and glass products;

- 47 – subclass that is used when souvenirs can be classified as food products:

- 47.2 – designation for the wholesale sale of publishing houses and stationery;

- 47.3 – indicates wholesale trade in other food products;

- 70 – subclass to define activities related to wholesale trade of all other types.

Choosing this code when registering for individual entrepreneurs who sell souvenirs will be absolutely correct. Although this is far from the only option. After all, this code is used specifically for retail trade.

Commission trade in jewelry

Commission sale of jewelry is an alternative to pawnshop activity. Legal entities and individuals can engage in this type of activity.

The OKVED code “Commission trade in jewelry” can be selected from the following codes:

- “47.79.1” – trade in antiques;

- “47.79.3” – sale of other used goods;

- “47.99” – other trade outside shops and markets;

- “47.77” – sale of watches and jewelry (in specialized stores).

OKVED for subjects of the jewelry industry

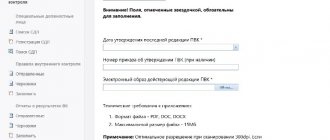

— filled out in the prescribed form, approved by order of the Ministry of Finance of the Russian Federation dated 02/01/2021. No. 5n “On approval of document forms required for special accounting of legal entities and individual entrepreneurs carrying out transactions with precious metals and precious stones.”

Based on Federal Law No. 115-FZ of 08/07/2021, legal entities and individual entrepreneurs registered with the Assay Supervision Inspectorate must develop and approve internal control rules. To implement internal control rules, you should use the List of organizations and individuals in respect of which there is information about their participation in extremist activities and the List of persons involved in the proliferation of weapons of mass destruction. Organizations and individual entrepreneurs engaged in jewelry activities have access to the Lists through their personal account on the portal of the Federal Service for Financial Monitoring (hereinafter referred to as Rosfinmonitoring).

Commission trade in cars

Many citizens of the Russian Federation refuse to buy used cars from private individuals in favor of proven and reliable organizations. The demand in this area is quite high, so the business of selling used cars can be very profitable. Before accepting a car for consignment trade, you should have it diagnosed at a service center.

The OKVED code “Commission trade in cars” is not included in the group “47.79”; it refers to a different type of activity. The code is selected as follows:

- In section “G” of the classifier we move to class “45”, then to subclass “45.1” “Trade in motor vehicles”.

- We are looking for the grouping “45.11”, this will be the required code for commission trade in motor vehicles.

The coding “45.11” is suitable for trading in both new and used cars and light-duty trucks. The sale of SUVs weighing no more than 3.5 tons also applies here.

As an additional code to OKVED “Commission trade in motor vehicles”, you can specify the code “47.99”.

Possible codes for commission trading are presented in our table.

Read also: Changing OKVED codes: step-by-step instructions

OKVED jewelry sale 2021

12 of Law No. 99-FZ, we have compiled this list: The licensed types of activities in 2021 do not always exactly correspond to OKVED codes, which must be indicated in the application for registration of individual entrepreneurs and LLCs. Some types of activities according to the OKVED classifier are almost completely repeated in the text of laws. But if we take as an example such a licensed area as pharmaceutical activity, then it will correspond to several OKVED codes at once. 2021, the following concept is given: “pharmaceutical activities - activities that include wholesale trade in medicines, their storage, transportation and/or retail trade in medicines, their dispensing, storage, transportation, manufacturing of medicines.” OKVED codes permitted for pharmaceutical activities will be as follows: Working without a license, if by law this activity must be licensed, is punishable by fines, confiscation of property, equipment and materials, and other sanctions.

These types of activities in the Russian Federation are regulated by separate laws: As you can see, these are mainly areas that require serious financial investments, so small businesses rarely choose such areas of activity, with the exception of the sale of alcohol. But the list of licensed types of activities specified in Law No. 99-FZ of 2017 includes many areas popular among novice businessmen, so we suggest that you familiarize yourself with it in more detail. Types of activities in Russia for which a license must be obtained in accordance with Art.

We recommend reading: Commercial kindergarten with state support 2021 Perm

How is commission trading done?

The operating principle is very simple and includes the following operations:

- They bring you an item for sale.

- You inspect it and ask for packaging, technical data sheets and instructions for equipment, video and photo equipment, and household equipment.

- Set a price.

- Write an agreement indicating the acceptance date, cost and sale period.

- Specify the amount of remuneration and the terms of payment.

Some products are subject to special standards: for jewelry - this is decree number 55, for cars - property documents.

In addition, you can provide additional services if you have certified specialists: assess objects and provide delivery of heavy cargo.

If the seller sells the item for more than planned, the benefit is divided equally between both parties.

Accounting for commission trade and postings to the commission agent

In accounting, the off-balance sheet account 004 must reflect the cost of the product established by the seller and the person who brought the product to your retail store.

At the time of sale, a receipt appears, and a debt arises to the supplier. Accounts payable are formed based on the price at which the sale was made. The seller is obliged to record this transaction. Only the commission markup, that is, the difference between the sales and valuation prices, is included in the calculation of profit.

Postings

Support is confirmed by primary documents and occurs according to a certain algorithm, guided by legal standards:

- receiving property from the supplier;

- subsequent sale by point;

- writing off the cost of products from the balance sheet;

- revenue from work done;

- payment for the safety of the product;

- VAT calculation;

- receiving money from the buyer;

- transfer of funds to the continent after the sale;

- receiving profit from the primary owner.

The legislative framework

The entire algorithm of actions is described in paragraphs of Articles 990, 991, 999 and 1001 of the Civil Code of the Russian Federation. In order not to delve into the legal subtleties, we will describe this procedure in a brief form:

- You bring an item to a retail outlet.

- An intermediary between you and the buyer, who does not have ownership of your item, makes a visual inspection and sets a specific price.

- If you are satisfied with the proposed valuation, you sign an agreement stating that the commission agent, on behalf of the principal, will sell this product for a fee (the amount is also indicated).

- Please indicate the notice period for the sale in advance.

- After this, the product is accepted and an invoice is drawn up in the TORG-12 form.

- The law states that goods received must be placed on the display shelf on the second day after receipt.

- After successful sale, the seller draws up a report indicating the name of the item, quantity, day of sale and amount of remuneration.

- It is advisable for the commission agent to draw up a statement that he has provided this service.

- Ultimately, the proceeds are transferred to you, and you give the seller a percentage of the sale.

- The collaboration is over.

- If you are not satisfied with something, you can file a complaint within 30 days.

Currently, this process has been improved thanks to automation and has become much better and faster. By installing software from a Russian developer of mobile accounting systems, you can create an automated agreement, which will contain information about acceptance, sales, commission and reporting.

OKVED 2021 for jewelry

The All-Russian Classifier of Types of Economic Activities (hereinafter referred to as OKVED) is nothing more than one of the documents from the set of documents of all-Russian classifiers of technical, economic and social information.

You can see the full table of sections and groups with decoding of codes and names below. Each group from the section has more than one serial number. However, only the basic names are presented in the main table. Each group with its serial number has a number of sub-items, which include narrowing the activity and assigning a code to each subgroup, up to a six-digit one

Licensing requirements and list of documents

1. License to carry out activities for the purchase from individuals of jewelry and other products made of precious metals and precious stones, scrap of such products (hereinafter referred to as purchase)

License requirements:

- the presence of buildings and premises in which activities are carried out on the right of ownership or on another legal basis;

- the presence of at least one employee (with the exception of individual entrepreneurs obtaining a license for themselves personally) who has:

- higher education in the field of training “Commodity Science”;

- or secondary vocational education in the field of training “Commodity science and examination of the quality of consumer goods”;

- or additional professional education under a continuing education program (at least 72 hours) in the field of purchasing;

- or at least one year of experience in the purchasing field;

- the presence of a system for recording, storing and ensuring the safety of precious metals that meets special requirements for technical strength and equipment with security and fire alarm systems;

- availability of the necessary weighing equipment (on the right of ownership or other legal basis).

List of documents attached to the application:

- copies of documents confirming the existence of buildings and premises on the right of ownership or other legal basis;

- a copy of the employment contract concluded with an employee who meets the qualification requirements (with the exception of individual entrepreneurs obtaining a license for themselves personally);

- copies of documents confirming the presence of premises that meet special requirements for technical strength and equipment with security and fire alarm systems;

- copies of documents confirming the ownership or other legal basis of weighing equipment;

- list of attached documents.

2. Activities for processing (recycling) scrap and waste precious metals

License requirements:

- the presence of buildings and premises in which activities are carried out on the right of ownership or on another legal basis;

- availability of the necessary weighing equipment (on the right of ownership or other legal basis);

- the presence of at least one employee (with the exception of individual entrepreneurs obtaining a license for themselves personally) who has:

- higher or secondary vocational education in the field of training “Technology of Materials”;

- or additional professional education under a professional development program (at least 72 hours) in the field of licensed activity;

- or work experience in the field of licensed activity for at least one year;

- the presence of a system for recording, storing and ensuring the safety of precious metals that meets special requirements for technical strength and equipment with security and fire alarm systems.

List of documents attached to the application:

- copies of documents confirming the existence of buildings and premises on the right of ownership or other legal basis;

- copies of documents confirming the ownership or other legal basis of weighing equipment;

- copies of documents confirming the presence of premises that meet special requirements for technical strength and equipment with security and fire alarm systems;

- a copy of the employment contract with an employee who meets the qualification requirements (with the exception of individual entrepreneurs obtaining a license for themselves personally);

- list of attached documents.

In addition, changes have been made to the Rules for the purchase from citizens of jewelry and other household products made of precious metals and precious stones and scrap of such products (approved by Decree of the Government of the Russian Federation of June 7, 2001 No. 444). Now these Rules apply to the purchase of any products, not just household ones.

We remind you that on August 13, 2021, the Federal Law of August 2, 2021 No. 282-FZ “On Amendments to the Federal Law “On Precious Metals and Precious Stones” and Article 12 of the Federal Law “On Licensing of Certain Types of Activities” came into force, which classified these types of activities as licensed. The license must be obtained no later than January 1, 2022 .

Attention! The Accept Group company provides consulting support on licensing activities:

- for the purchase from individuals of jewelry and other products made of precious metals and precious stones, scrap of such products;

- for the processing (processing) of scrap and waste of precious metals (with the exception of activities for the processing (processing) by organizations and individual entrepreneurs of scrap and waste of precious metals generated and collected by them in the process of their own production, as well as jewelry and other products made of precious metals of their own production, unsold and returned to the manufacturer).

To get a consultation

Also at Accept Group Company you can use the following services and documents for companies and individual entrepreneurs operating in the jewelry industry:

- A package of documents on organizing work with precious metals and precious stones (jewelry)

- Providing information to Rosfinmonitoring

- Rules for internal control of individual entrepreneurs carrying out transactions with funds or other property, and primary documentation on AML/CFT/PF

- Targeted AML/CFT training and knowledge enhancement

- Package of documents on the protection of personal data

- Package of documents on labor protection

- Package of documents on anti-corruption.

Order documents Order a call

Find out more about the composition and cost of services from your personal manager by phone: 8 800 333-94-52